Dutch Pension funds do not vote in line with climate ambitions

Authors note rectification 13 April 2023

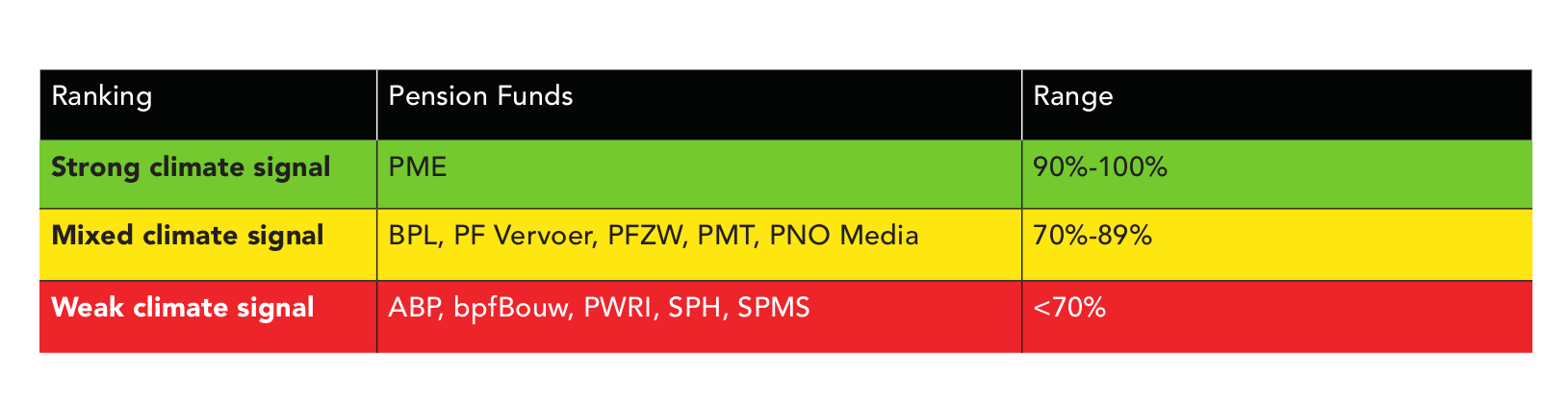

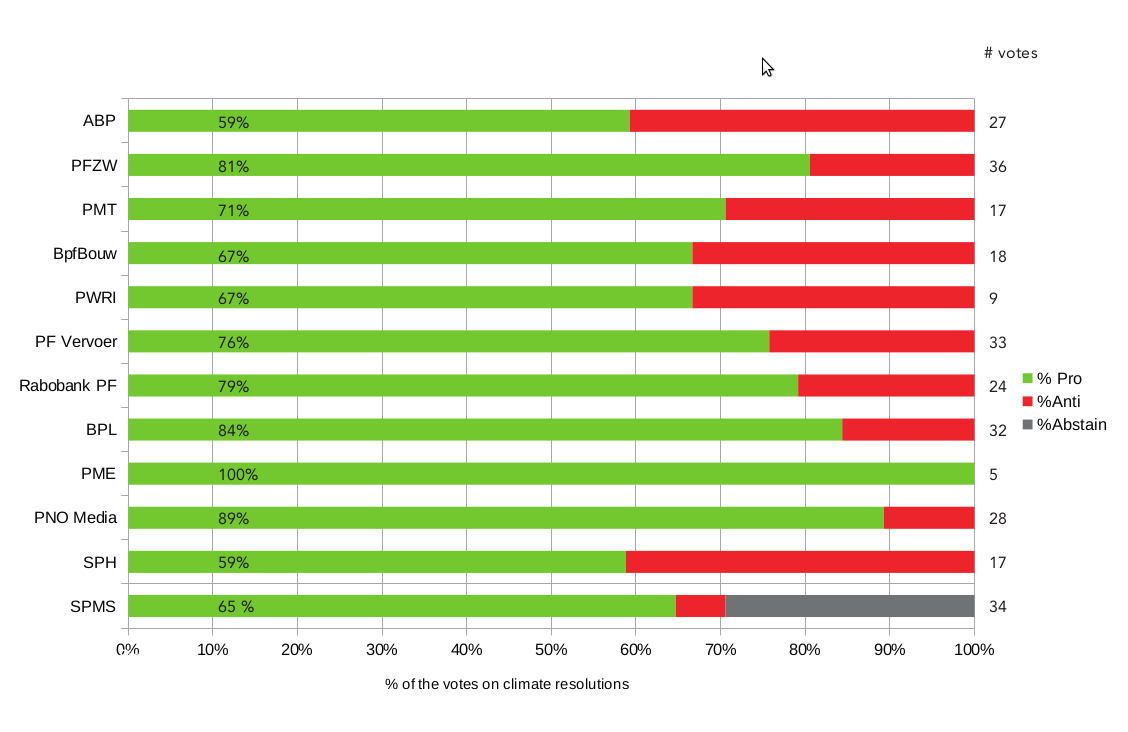

Most Dutch pension funds and their asset managers do not vote consistently in favour of climate resolutions at the oil and gas companies and banks in which they invest. That is the conclusion of a report published today by Both ENDS and Groen Pensioen. Eleven of the twelve* Dutch pension funds studied have made public statements and pledges about adapting their policies in line with the Paris Climate Agreement. But their voting behaviour does not sufficiently correspond with these pledges. Only pension fund PME votes for 100% in line with its own climate promises.

None of the companies involved in fossil fuels has drawn up a credible business plan compatible with the 1.5 degree goal agreed in Paris. Participants in pension plans have been calling on their pension funds for many years to withdraw from the fossil sector, but too little comes of that in practice. Some pension funds continue to invest in the sector with the stated intention to use their influence as shareholders to push fossil companies in the right direction. This study shows, however, that pension funds exert their influence insufficiently and that their engagement has hardly led a change of course among fossil companies.

Banks out of the fossil sector too

The researchers focused on voting behaviour on climate resolutions at oil and gas companies and banks. The latter play a key role as, without financing, fossil projects cannot be implemented. "Eleven of the twelve pension funds and their asset managers that we studied did not use their votes to send sufficiently strong messages," says Cindy Coltman of Both ENDS. "To have a realistic chance of keeping global warming below 1.5°C, it is essential that pension funds stop investing in oil and gas companies and exert pressure on banks to stop financing the fossil sector. And that is not happening enough."

Clear expectations

Pension funds normally vote in 75% to 98% of cases in favour of general resolutions, for example on the appointment of board members or management plans. The report shows that, in the case of climate resolutions, that percentage is much lower. Most pension funds vote in favour of the climate in only 58% to 89% of cases. "We would expect pension funds that claim to take the climate seriously to vote in favour of all resolutions that will have a positive effect on the climate," says Marjolein van Dillen of Groen Pensioen. "They have to overcome their fear of being 'too controlling or too difficult' for the companies in which they invest, and indicate clearly what they expect of the companies in terms of climate policy."

Using their influence

The researchers think that pension funds should lay out a clearer vision on fossil and sustainable investments. And they should be much more assertive in using the influence they have to redirect financing towards the renewable sector and climate solutions.

"We have seen that pension funds can show genuine leadership," says Coltman. "ABP and PME have almost entirely phased out their investments in fossil companies. That means that the pension funds we studied can utilise their engagement much more effectively or, if they really want to effect change, can withdraw from the fossil sector completely. We also believe that they should be much more transparent towards their pension savers about their plans and engagement in that respect. 'Business as usual' is no longer an option in a world that is wrestling with enormous climate problems".

* The pension funds studied were ABP, PFZW, PMT, BpfBouw, PWRI, PF Vervoer, Rabobank PF, BPL, PME, PNO Media, SPH and SPMS

For more information

Read more about this subject

-

Publication / 8 maart 2023

-

Publication / 14 mei 2017

-

Publication / 9 mei 2018

-

Press release / 14 mei 2017

Press release / 14 mei 2017Criticism of Dutch pension fund ABP’s investments in coal, oil and gas

The Dutch pension fund, ABP, invested about two billion euros more in the fossil energy industry at the end of 2016 than the year before. This is announced by the report "Dirty & Dangerous: the fossil fuel investments of Dutch pension fund ABP," published today by Both ENDS, German urgewald and Fossielvrij NL. The report criticizes these investments because of the impact on the climate and the catastrophic consequences for the people in the areas where coal, oil and gas are being produced.

-

News / 1 mei 2019

News / 1 mei 2019ABP still on collision course with Paris climate goals

Amsterdam 1 May 2019 - Dutch pension fund ABP's 'sustainable and responsible investment report’ today suggests that the pension fund is well on track in terms attaining its internal sustainability goals. However, an analysis by Fossielvrij NL, Both ENDS, urgewald and Greenpeace shows that ABP remains on a collision course with the Paris climate goals. At the end of 2018, ABP still invested 16.5 billion Euros in the fossil industry. ABP's investments in the world's 44 largest climate polluters even increased between 2016 and 2018.

-

Publication / 14 mei 2017

-

Publication / 9 mei 2018

-

Event / 18 juni 2022, 12:30

Event / 18 juni 2022, 12:30"Stop Fossil Finance" block Climate March

Still, more funds are spent on the fossil industry than on sustainable solutions. Banks, pension funds, insurers and governments keep investing in fossil infrastructure which endangers people and the environment. Therefore we call on financial institutions to stop funding the climate crisis.

Join our "Stop Fossil Finance" block at the next climate march!

-

Press release / 9 mei 2018

Press release / 9 mei 2018ABP promises to go green but sticks with fossil fuels

New research by Both ENDS, Fossielvrij NL and urgewald shows that, in 2017, pension fund ABP invested 500 million euros more in coal, oil and gas than in the previous year – a total of 10.9 billion euros. These investments in fossil fuels not only stand in sharp contrast to ABP's claim that it has achieved substantial successes in its climate policy, but are also in flagrant violation of the Paris climate agreement. Unlike international forerunners among pension funds, ABP continues unabated to invest in the fossil energy sector.

-

News / 2 februari 2020

News / 2 februari 2020How to become a fossil-free investor

The world has to stop using fossil fuels, but investment in the sector continues unabated. Investors of all kinds, including banks, insurance companies and pension funds, are hesitant about making the change to sustainable energy and are not sure where to start. In the autumn of 2019, together with the DivestInvest Network and Sustainable Energy (Denmark), Both ENDS published a report entitled ‘Managed Decline of Fossil Fuel Businesses’. The report describes five criteria to test whether companies in the fossil sector are actively taking steps to wind down their fossil activities. The criteria are helping investors to choose investments that are in line with the Paris goal of restricting global warming to a maximum of 1.5 degrees Celsius. We spoke to Lars Jensen, Senior Analyst at Sustainable Energy and lead author of the report.

-

Press release / 4 oktober 2023

Press release / 4 oktober 2023New database names companies blacklisted by global investors and banks

A coalition of NGOs today launched the Financial Exclusions Tracker, a new website that tracks which companies are being excluded by investors and banks for sustainability reasons. Most excluded corporations are barred due to links to fossil fuels, weapons or tobacco.

-

Dossier /

Dossier /Making pension funds more sustainable

Pension funds have a lot of influence because of their enormous assets. Both ENDS therefore wants pension funds such as the Dutch ABP to withdraw their investments from the fossil industry and to invest sustainably instead.

-

Press release / 26 oktober 2021

Press release / 26 oktober 2021New report: 33.7 billion euro's worth of assets have committed to fossil fuel divestment

Today, on the eve of the UN Climate Change Conference, COP26, the fossil fuel divest-invest movement released a new report that details how institutions representing an unprecedented total of EUR 33.7 trillion worth of assets have now committed to some form of fossil fuel divestment, a figure that's higher than the annual GDP of the United States and China combined.

-

Publication / 23 oktober 2019

-

External link / 31 oktober 2021

External link / 31 oktober 2021A chance worth 1.5 billion euros to stimulate renewable energy

In this short video, Niels Hazekamp of Both ENDS talks about how the Netherlands stimulates projects related to the fossil sector abroad through its export credit agency (ECA) Atradius DSB. The ECA provides export credit insurance for very large-scale and high-risk activities abroad. About two thirds of this export support (worth around 1.5 billion euros per year) is going to the fossil fuel sector. Absurd, at a time when the whole world has to make the transition to sustainable energy. Our country should not support the fossil, but the renewable energy sector with such guarantees, and grab that chance of 1.5 billion!

-

Press release / 22 juni 2020

Press release / 22 juni 2020Press release - Climate movement: “Pension funds, stop investing in fossil gas”

Amsterdam, Copenhagen 22 June 2020 – In these times of increasing climate crisis, corporate social responsibility also means that investments in fossil gas must be phased out as quickly as possible. In a world in which a maximum temperature rise of 1.5 Celsius is the norm, fossil gas cannot be a 'transition fuel' towards sustainable energy. This is the message from five European environmental organisations (Both ENDS, the Danish AnsvarligFremtid, Fossil Free Sweden, Fossil Free Berlin and the Italian Re:Common) to pension funds in their countries that still invest in fossil gas companies. They are promoting that message with a new campaign called "Gas Free Pensions", which is being launched today.

-

Press release / 23 september 2019

Press release / 23 september 2019World's 5th largest pension fund ABP increases fossil fuel investments

Amsterdam, 23 September 2019 - The world's 5th largest pension fund, with assets of over €430 billion, Dutch ABP is continuing to invest in companies that are on a collision course with the Paris climate goals, such as coal and oil companies.

-

Press release / 24 oktober 2019

Press release / 24 oktober 2019Press Release: These five criteria help investors go green

Press release 24 October 2019

Starting today, investors can use five criteria to test whether companies in the fossil sector are actively working on phasing out their fossil activities. Too many investors still seem hesitant to switch to a profitable future of sustainable energy and these criteria should help them do this. The organisations DivestInvest Network, Sustainable Energy (Denmark) and Both ENDS (the Netherlands) publish the report "Managed Decline of Fossil Fuel Businesses" today, which describes these five criteria. The criteria aim to help investors choose investments that are in line with the Paris goal "stay below 1.5 degrees Celsius warming." The recommendations are presented at the World Pension Summit deliberately, because pension fund investors in particular can take more responsibility in this.

-

News / 9 februari 2022

News / 9 februari 2022Urgent letter to Dutch investors in Ugandan oil pipeline

TotalEnergies and the Chinese National Offshore Oil Cooperation (CNOOC) are currently developing an oil extraction and transportation project in Uganda: East African Crude Oil Pipeline (EACOP). The project – the construction of a heated pipeline (EACOP) of no less than 1445 kilometers through Uganda and Tanzania to export crude oil, is increasingly causing human rights violations and environmental damage. This is a matter of great concern to civil society organisations in Uganda and beyond. This week, Both ENDS, together with partner organisations in Uganda, sent an urgent letter to twelve pension funds and asset managers with investments in TotalEnergies and CNOOC.

-

News / 8 november 2021

News / 8 november 2021The Netherlands will stop export support for fossil fuel projects, after all

Today, the Netherlands announced that it will join a leading group of countries, including the United States, Canada and Italy, which declared that they would stop international support for fossil energy projects. At the day of the launch of the declaration at the climate summit in Glasgow on the 4th of November, the Netherlands had no intention of joining, but because of pressure from civil society and political parties, the responsible ministries decided to sign after all. Both ENDS, together with organizations at home and abroad, has been pushing for this for years, and we are very happy with this step. We will of course continue to monitor developments.