Making pension funds more sustainable

Pension funds have a lot of influence because of their enormous assets. Both ENDS therefore wants pension funds such as the Dutch ABP to withdraw their investments from the fossil industry and to invest sustainably instead.

Pension funds are major investors. For example, the Dutch pension fund for the public sector, the General Civil Pension Fund (ABP), is one of the largest pension funds in the world; one in six Dutch people is a participant. The total invested capital of ABP amounts to more than 400 billion euros.

Fossil investments contribute to climate change

Pension funds invest their money worldwide to guarantee a good pension for their members. Unfortunately, short-term profits are often considered more important than a sustainable future for people and the environment. Many pension funds invest large amounts in the fossil fuel industry, such as coal plants or oil and gas companies. Their investments in the fossil companies enable this industry to continue their activities, because those investments must be earned back.

However, people in the Global South are experiencing the effects of climate change earlier and harder than people in the Global North. At the same time, women and men in the Global South are also front line environmental defenders, and fighting the expansion of fossil fuel extraction in their localities. We think that global investors have a proactive role to play in our collective aim for 1.5 degrees as the red line for global warming.

That is why fossil investments by pension funds must be phased out as soon as possible. As a result, the fossil companies will lose their social license to operate, which speeds up progress in realising the Paris Climate Agreement. In Paris, the world has agreed to drastically reduce CO2 emissions and thereby limit global warming to 1.5 degrees.

Pension funds also invest in industries that are known for their major human rights and environmental issues, such as mining, and soy and palm oil plantations.

Tracking ABP's investments

Both ENDS wants to encourage pension funds to divest their assets from harmful sectors. We focus primarily on ABP, the largest pension fund in the Netherlands. ABP wants to be a "sustainable pension fund", as stated in its Vision 2020.

The analysis that Both ENDS, FossielVrij Netherlands and German urgewald have been doing of ABP's investments, however, show that not much of that is yet coming true. In both 2016 and 2017, ABP turned out to have invested more in coal, oil and gas than in the previous year. We think this is not in line with ABP's own vision, but it cannot be reconciled with "Paris" either. That is why we will continue to critically monitor ABP's investments, together with FossielVrij Netherlands.

DivestInvest

Other major investors from all over the world have already shown that it is possible. Various pension funds, such as New York City's five pension funds, have withdrawn all their investments in the fossil industry. The Dutch BPL, the pension fund to which Both ENDS is affiliated, has divested from the coal industry.

Moreover, in early 2019 a group of wealthy Dutch people decided to remove all their personal assets from the top 200 oil, gas and coal companies. These Dutch people are part of the Dutch branch of the worldwide DivestInvest movement, which is supported by Both ENDS, Fossielvrij Netherlands and Stichting DOEN. By investing in climate solutions such as renewable energy, sustainable agriculture and efficient water use instead of polluting sectors, the DivestInvest movement wants to stimulate climate action and accelerate the energy transition.

For more information

Read more about this subject

-

Dossier

Uganda’s Energy Future

Despite the existence of many hydropower dams, foreign investments and large government spending on energy, and new plans for hydropower, oil and gas projects, the vast majority of rural Uganda still remains without electricity. Together with our local partners we are striving towards a sustainable energy strategy for Uganda that starts from the needs and wishes of local communities.

-

Press release / 27 September 2022

Call to Dutch investors: get out of TotalEnergies

Utrecht/Amsterdam, 27 September 2022 - On Wednesday 28 September, Dutch civil society organisations will organise a protest at the offices of oil giant TotalEnergies in The Hague, drawing attention to the problems surrounding the East African Crude Oil Pipeline (EACOP) in Uganda. They are calling on investors to get out of TotalEnergies because of this project, which is causing human rights violations and serious environmental pollution. Two weeks ago the European Parliament passed a resolution against the human rights violations linked to EACOP.

-

Letter / 22 September 2022

Letter to Dutch investors in TotalEnergies about EACOP project

A coalition of 13 Dutch organisations calls on investors like banks, pension funds and insurers to divest from TotalEnergies because of its EACOP project in Uganda and Tanzania. This new pipeline is causing human rights abuses, increased poverty, environmental pollution and climate change, and also TotalEnergies is using loopholes in the tax system to avoid taxes.

The letters has been send, among others, to the banks ABN AMRO, ING and Van Lanschot Kempen, pension funds ABP, BPL, PFZW, PMT and PNO media and the insurers Aegon, Allianz and Nationale Nederlanden. Together, the Dutch investors own shares and obligations worth more than 2.1 billion euros.

-

Event / 19 June 2022, 12:30

"Stop Fossil Finance" block Climate March

Still, more funds are spent on the fossil industry than on sustainable solutions. Banks, pension funds, insurers and governments keep investing in fossil infrastructure which endangers people and the environment. Therefore we call on financial institutions to stop funding the climate crisis.

Join our "Stop Fossil Finance" block at the next climate march!

-

Blog / 27 May 2022

Divest from EACOP before it’s too late

and Abigail Kyomuhendo*

This week the annual shareholder meeting (AGM) of TotalEnergies took place. Whilst the shareholders celebrated their profits, Ugandan people were being evicted from their lands, thousands of kilometers away, for Total's East African Crude Oil Pipeline (EACOP). -

Press release / 22 June 2020

Press release - Climate movement: “Pension funds, stop investing in fossil gas”

Amsterdam, Copenhagen 22 June 2020 – In these times of increasing climate crisis, corporate social responsibility also means that investments in fossil gas must be phased out as quickly as possible. In a world in which a maximum temperature rise of 1.5 Celsius is the norm, fossil gas cannot be a 'transition fuel' towards sustainable energy. This is the message from five European environmental organisations (Both ENDS, the Danish AnsvarligFremtid, Fossil Free Sweden, Fossil Free Berlin and the Italian Re:Common) to pension funds in their countries that still invest in fossil gas companies. They are promoting that message with a new campaign called "Gas Free Pensions", which is being launched today.

-

Press release / 6 May 2020

Press release: Fossil investments by pension funds aggravate economic blow

The value of ABP's pension fund investments in fossil fuel companies has fallen by 44% from end of last year to its lowest point on March 16 this year, while the value of the rest of the portfolio decreased by 26%. This impact can be seen in simulations based on the publicly available equity portfolios of Dutch pension funds ABP and Zorg en Welzijn (PFZW), carried out by research agency Profundo on behalf of Both ENDS. The simulations show that the risks of investing in the fossil fuel sector are increasing.

-

Press release / 3 February 2020

Climate movement: ABP takes steps on coal and tar sands, but oil and gas remain blind spot

Amsterdam, 3 February 2020 - A step forward, but oil and gas remain a blind spot in Dutch pension fund ABP's new investment policy published today. That's what environmental organisations Both ENDS, Fossielvrij NL, Greenpeace Netherlands and urgewald say in response to the new climate policy of the EU's largest pension fund, with assets over 442 billion euros. Although ABP is taking first steps to invest sustainably, more is needed to stop the climate crisis.

-

News / 2 February 2020

How to become a fossil-free investor

The world has to stop using fossil fuels, but investment in the sector continues unabated. Investors of all kinds, including banks, insurance companies and pension funds, are hesitant about making the change to sustainable energy and are not sure where to start. In the autumn of 2019, together with the DivestInvest Network and Sustainable Energy (Denmark), Both ENDS published a report entitled ‘Managed Decline of Fossil Fuel Businesses’. The report describes five criteria to test whether companies in the fossil sector are actively taking steps to wind down their fossil activities. The criteria are helping investors to choose investments that are in line with the Paris goal of restricting global warming to a maximum of 1.5 degrees Celsius. We spoke to Lars Jensen, Senior Analyst at Sustainable Energy and lead author of the report.

-

Press release / 24 October 2019

Press Release: These five criteria help investors go green

Press release 24 October 2019

Starting today, investors can use five criteria to test whether companies in the fossil sector are actively working on phasing out their fossil activities. Too many investors still seem hesitant to switch to a profitable future of sustainable energy and these criteria should help them do this. The organisations DivestInvest Network, Sustainable Energy (Denmark) and Both ENDS (the Netherlands) publish the report "Managed Decline of Fossil Fuel Businesses" today, which describes these five criteria. The criteria aim to help investors choose investments that are in line with the Paris goal "stay below 1.5 degrees Celsius warming." The recommendations are presented at the World Pension Summit deliberately, because pension fund investors in particular can take more responsibility in this.

-

Publication / 24 October 2019

-

Press release / 23 September 2019

World's 5th largest pension fund ABP increases fossil fuel investments

Amsterdam, 23 September 2019 - The world's 5th largest pension fund, with assets of over €430 billion, Dutch ABP is continuing to invest in companies that are on a collision course with the Paris climate goals, such as coal and oil companies.

-

Publication / 23 September 2019

-

News / 1 May 2019

ABP still on collision course with Paris climate goals

Amsterdam 1 May 2019 - Dutch pension fund ABP's 'sustainable and responsible investment report’ today suggests that the pension fund is well on track in terms attaining its internal sustainability goals. However, an analysis by Fossielvrij NL, Both ENDS, urgewald and Greenpeace shows that ABP remains on a collision course with the Paris climate goals. At the end of 2018, ABP still invested 16.5 billion Euros in the fossil industry. ABP's investments in the world's 44 largest climate polluters even increased between 2016 and 2018.

-

Publication / 9 May 2018

-

Press release / 9 May 2018

ABP promises to go green but sticks with fossil fuels

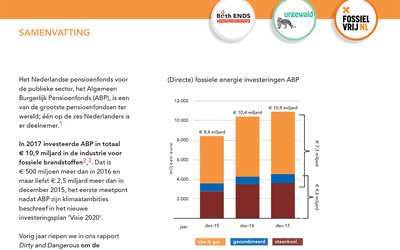

New research by Both ENDS, Fossielvrij NL and urgewald shows that, in 2017, pension fund ABP invested 500 million euros more in coal, oil and gas than in the previous year – a total of 10.9 billion euros. These investments in fossil fuels not only stand in sharp contrast to ABP's claim that it has achieved substantial successes in its climate policy, but are also in flagrant violation of the Paris climate agreement. Unlike international forerunners among pension funds, ABP continues unabated to invest in the fossil energy sector.

-

Publication / 9 May 2018

-

Press release / 14 May 2017

Criticism of Dutch pension fund ABP’s investments in coal, oil and gas

The Dutch pension fund, ABP, invested about two billion euros more in the fossil energy industry at the end of 2016 than the year before. This is announced by the report "Dirty & Dangerous: the fossil fuel investments of Dutch pension fund ABP," published today by Both ENDS, German urgewald and Fossielvrij NL. The report criticizes these investments because of the impact on the climate and the catastrophic consequences for the people in the areas where coal, oil and gas are being produced.

-

Publication / 14 May 2017

-

Publication / 14 May 2017